I started my dividend investing journey in 2018.

After watching several videos about dividend investing on Youtube I decided it was time to buy my first shares of KHC.

Warren Buffet owns it. The company is “boring” and has a solid business model. So, what can go wrong?

At that time the KHC share price came down and it had a decent start dividend yield of 3.39%.

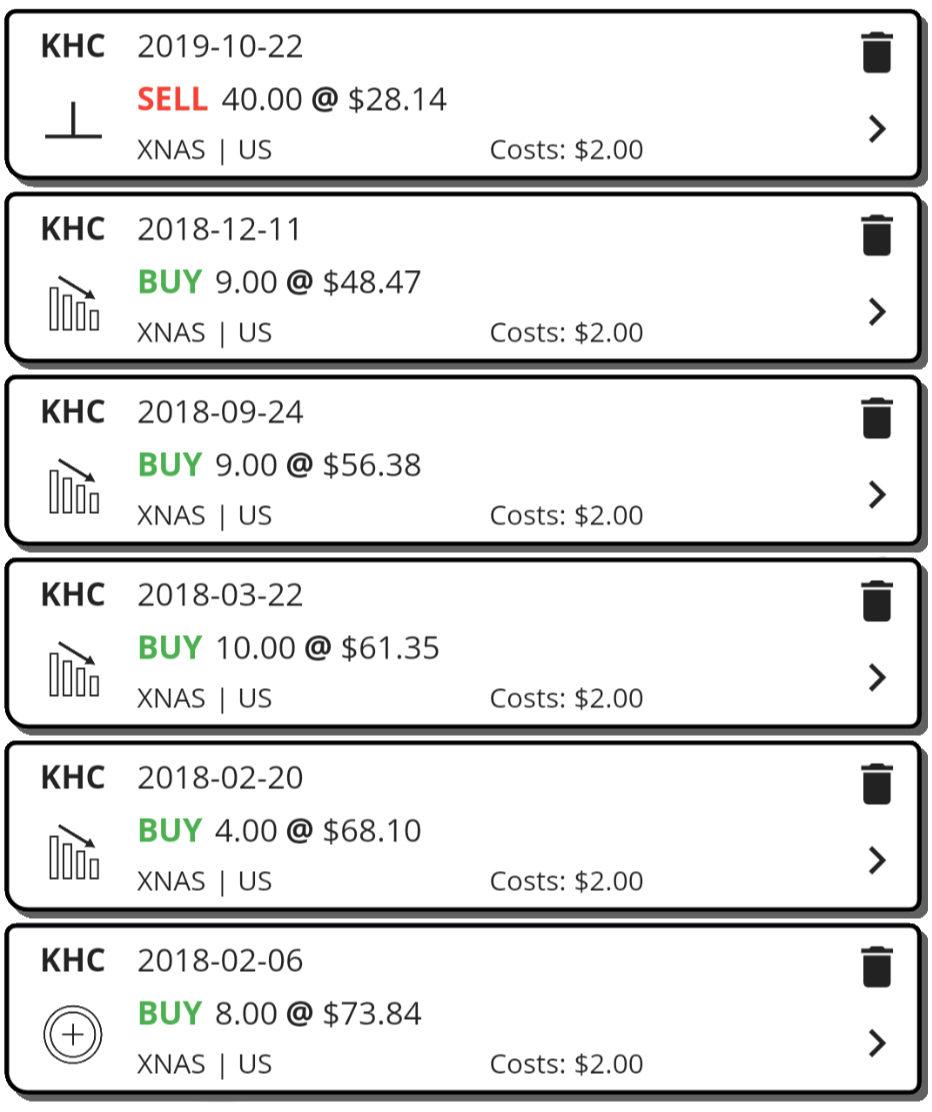

I bought my first 8 shares for $73.84 USD each in February 2018.

My first dividend payment of 5$ felt really motivating.

At that time I was already familiar with the concept of “cost averaging”: spread your purchases over a time-span to reduce the risk.

As the share price was trending further down, I collected more shares during the following months. Great.

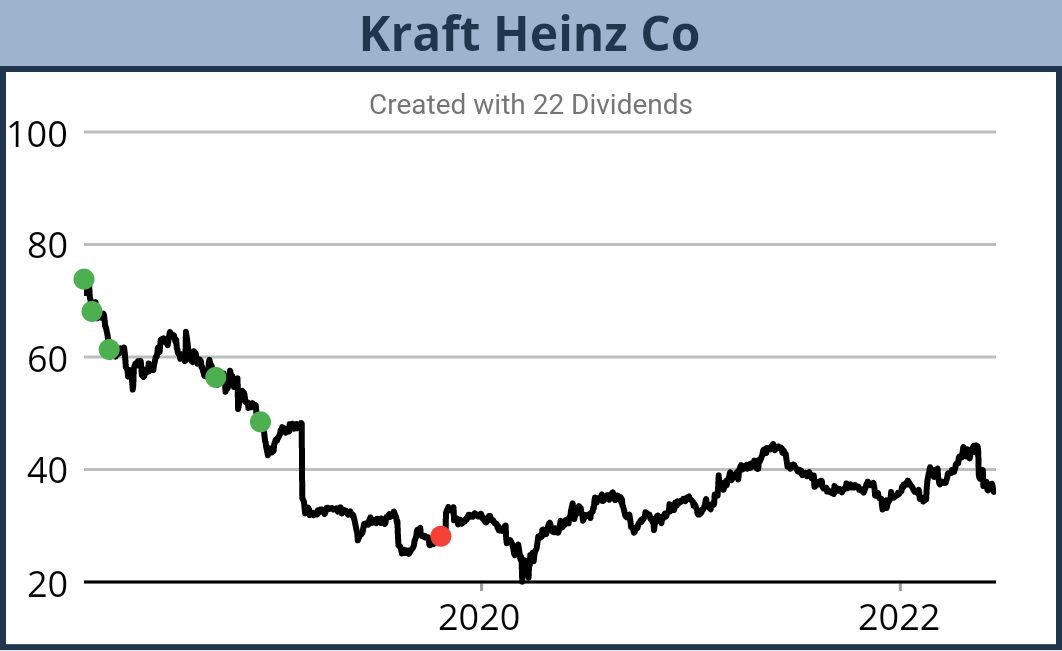

But the share price did not stop falling. It was in a steady downtrend.

I thought: “It has to reverse at some point in time. Stocks go up in the long-term.”

In February 2019 the share price had a sudden drop of 25% as the dividend was cut by about 36%.

It took me eight more months until I finally gave up on KHC.

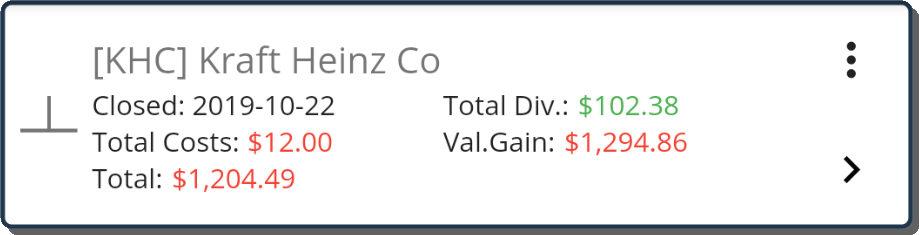

Why did I wait so long? What I learned about myself is that cutting losers is probably the most difficult thing for me. I need hard rules that guide me: e.g. close a position if the losses exceed -20%.

With such a rule in place I could have saved money and more importantly time.

Lessons learned:

- One of the most fascinating things about the stock market is the psychology involved. You can learn a lot about yourself.

- Do your own research before buying and don’t rely on Youtube videos. Just because a famous investor holds a stock it does not have to be a good investment for you.

- Dividend investing is about holding stocks for a long time. One of the most difficult decisions is when to get out of a position.

- A cheaper share price is not always a buying opportunity. What is the reason for the drop?

- A loss of 50% means that the stock has to gain 100% again just to compensate for the loss. Is this realistic?

- Every investment can go wrong. Be mentally prepared. Open a position with a plan and a predefined stop-loss threshold for selling. Losing positions are part of the game. It is about how you manage those positions. It is not a shame to close a loser.

- If you are just starting out with dividend investing, use small amounts of money (which I did luckily).

Despite this negative experience I kept on investing in dividend stocks!

-

This topic was modified 3 years, 7 months ago by

swarwas.

swarwas.